Self-directed retail investors' turnover in US securities with a global investor origin.

VandaTrack

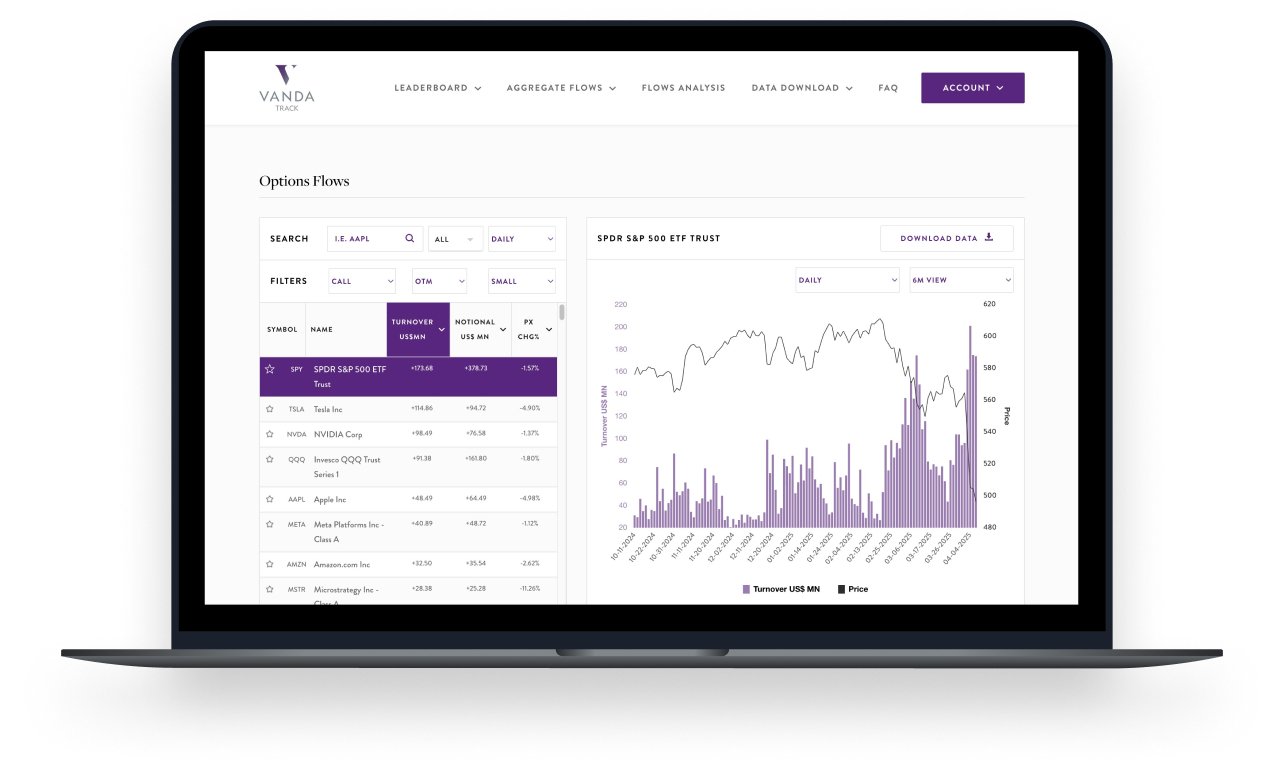

Daily retail investor flows and options data across all U.S listed stocks and ETFs on one platform.

Analyze and Track the Most Traded, Bought, and Sold Securities Daily

Uncover opportunities with our daily retail investor data, complemented by the VandaTrack Update, a dedicated qualitative research note exclusive to VandaTrack clients.

Seamless Integration

Access thousands of datasets via a customisable web interface or seamlessly through our API for automated data delivery.

"The Crowd" Isn't Who It Used To Be

That’s why we’re decoding retail flow to help you separate the signal from the noise with VandaTrack, a real-time data platform that provides institutional investors with daily insight into global retail investor activity, tracking net purchases of US listed single stocks and ETFs.

Track daily trading flow across all 10k+ US-listed stocks and ETFs and flow analysis

Seamless integration for quants & discretionary traders

See which names dominate retail options turnover by premium traded

Analyse retail activity and filter securities by benchmark, sector, factor, and theme

VandaTrack Update

Focus: Retail Investor Activity | Market-Moving Events

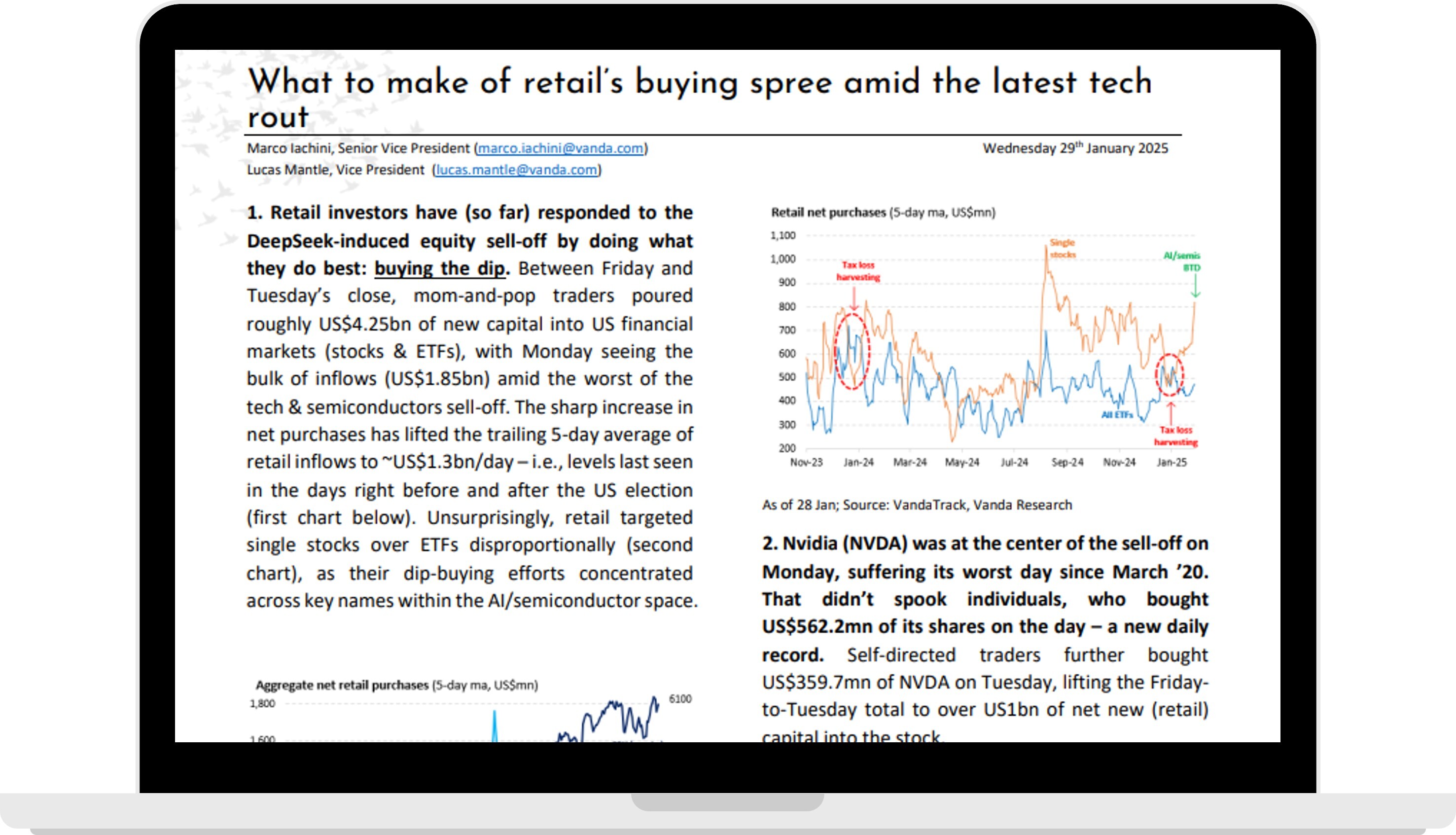

Our regular update on individual retail traders' activity leveraging our VandaTrack retail flow data platform. The report provides insights on the most important narratives and themes driving retail traders' behaviour and their impact on markets.

-

Detect which securities are being driven by retail crowding

-

Understand the key themes underpinning retail's buying and selling decisions

-

Visualize the data in charts to help you extract signal from the noise

Frequently Asked Questions and Support

Some of our most asked questions regarding VandaTrack.

What type of data is this?

Where is your data from?

Our data is from all traded securities ex pink sheet across the US Market using stock ticker symbols as identifiers.

How often is the data updated?

Daily with a time lag of 9 hours.

Can I add this data into my own models?

Yes, via REST API, AWSS3, or via ad-hoc SFTP.

Let's Talk Positioning

Have questions or want to find out more about our VandaTrack data?

Contact us directly and we can answer your questions in more detail.

Insights and News

Want to learn more about how Vanda helps institutional investors? Explore the the latest news and insights or get in touch to find out more about our data, research and advisory services.