Nasdaq: Retail investors buck flows trend to add to energy ETFs

4 Aug 2022

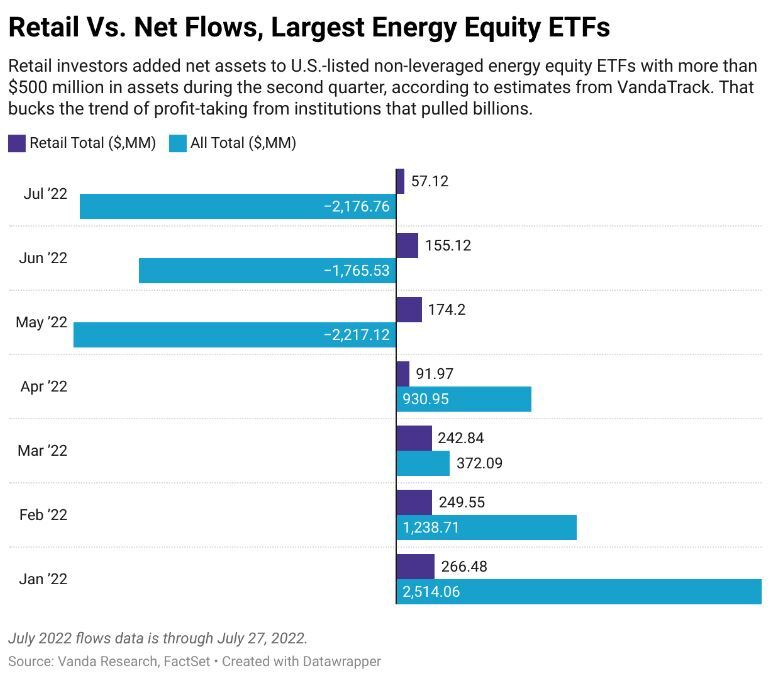

Estimates of retail action from VandaTrack show individual investors added more than $386 million in non leveraged energy-focused equity ETFs with more than $500 million in assets from May to late July, while the same group of funds took net outflows of nearly $6.7 billion.

To read full article, please click here

For further information on this data please contact sales@vanda.com

Insights and News

Want to learn more about how Vanda helps institutional investors? Explore the the latest news and insights or get in touch to find out more about our data, research and advisory services.