Vanda turns bearish US Equities

22 Dec 2020

TAAM: Short equities, short USTs and long USD

A few things have triggered our bearish US eq view this month:

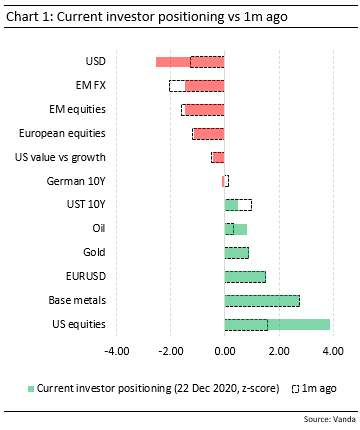

- Positioning has grown materially more exuberant over the past few weeks, a trend best seen in the market’s current +3.9 SD positioning in US equities and -2.5 SD positioning in USD…

- The fact that we’ve seen pretty much all of the positive catalysts investors could have hoped for this month: resolution in the US presidential race, official approval of multiple Covid vaccines and a stimulus bill… and

- The upcoming Georgia runoff, a risk which remains under-hedged and under-appreciated by market participants.

For further information about this research publication contact us at sales@vanda.com.

Insights and News

Want to learn more about how Vanda helps institutional investors? Explore the the latest news and insights or get in touch to find out more about our data, research and advisory services.